by Nicolas L. Waddy

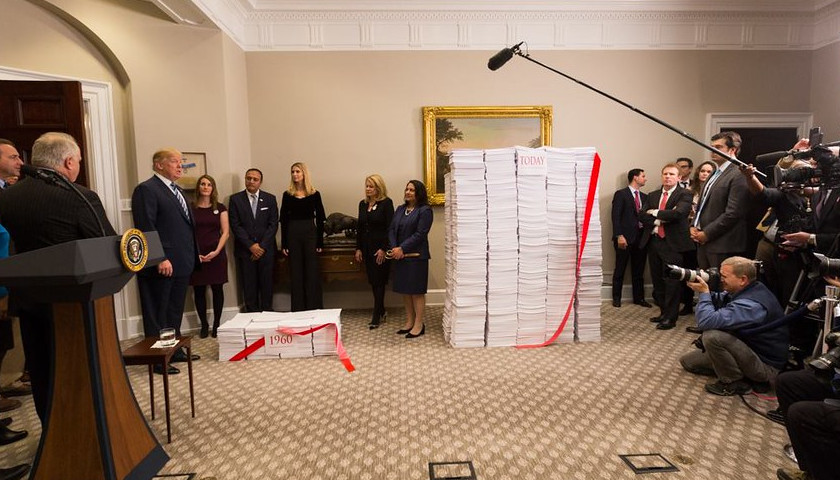

As Democratic presidential candidates stumble over one another in a headlong rush towards socialism and fiscal insanity—promising trillions in new spending on everything from childcare, health care, and higher education for all, to “the Green New Deal” and slavery reparations—President Trump faces a critical choice.

He could try to match the Democrats and promise more expansive government programs; he could instead offer to put more money in Americans’ pockets through tax cuts; or he could do neither and stress fiscal responsibility, holding the line on new spending and tax cuts in favor of reducing the federal deficit.

Although the last choice is the least exciting, especially in an election year when people expect to be offered a cornucopia of “free stuff,” it is the right choice for America, especially given the fiscal challenges we currently face.

This year, our deficit will exceed $1 trillion for the first time since the Great Recession. Now is not the time to be spending wildly or to be slashing government revenues through tax cuts. Now is the time to tighten our belts and return government finances to long-term sustainability, especially given the fact that the aging of the U.S. population means that massive spending obligations are coming soon.

To date, President Trump’s philosophy on federal spending has been ambiguous. On the one hand, he touts fiscal responsibility and a commitment to reducing federal deficits. On the other, the president has cut taxes while simultaneously presided over a massive increase in spending.

Often, he boasts about his administration’s “investments” in Republican priorities such as border enforcement and defense. Arguably, Trump is playing the Democrats’ own game, parroting their view that a politician’s virtuosity and even his humanity can be measured by his willingness to spend other people’s money.

New Tax Cuts on the Table?

Lately, there is some evidence that Trump’s advisers want to keep pushing this high spending/low taxation strategy for currying favor with voters. Although the 2017 Tax Cuts and Jobs Act lowered middle-class taxes—albeit modestly—now the Trump Administration is considering further reductions to marginal tax rates for middle-income earners. The idea seems to be to establish a 15 percent rate that would kick in for those who may now be paying 22-24 percent.

No one likes income taxes or the IRS, but the American people ought to be skeptical of such proposals.

Already, our deficit has inched up to almost 5 percent of GDP, a level that economists believe to be unsustainable. Trump’s previous tax cuts were close to revenue neutral, but cuts on the scale now being proposed could be far more serious.

The Coming Entitlement Tsunami

Remember the broader context: Social Security, Medicare, and Obamacare spending all are forecast to surge in the coming years. So far, inflation and interest rates have remained low, and the United States has been able to service its huge national debt with relative ease. If we were to depart totally from the path of fiscal responsibility, however, as Trump’s advisers suggest, we have to wonder whether the wheels could come off—not just in respect to federal finances, but the overall U.S. economy. In that case, a negative feedback loop could lead to a severe recession, or even a depression.

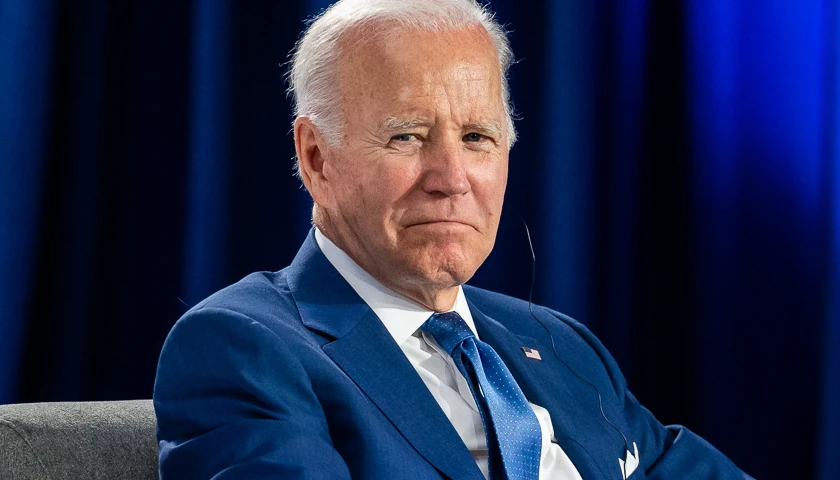

President Trump should also consider the political “optics” of pushing further tax cuts in an election year in which the eventual Democratic candidate will be promising the American people a laundry list of new entitlements, as well as tax breaks. Does Trump really want to compete with the Democrats for the job of Benefactor-in-Chief, or would he be better off drawing a sharp contrast with free-spending liberals?

The Democrats’ nominee will be offering a vision of unprecedented growth in governmental power, unbridled hostility to job creators, and almost limitless federal spending. Presumably, it would be easy to argue in response that Democratic promises are empty, reckless, or both. But if Trump is making irresponsible claims and promises of his own about either spending or taxation, his appeal as the economic voice of reason could be blunted. A socialist could then enter the White House through the back door.

President Trump should level with the American people. Tell them that, at this point in our history, huge new spending commitments are neither affordable nor prudent. Given the future expenses that are already locked in, especially for Social Security and Medicare, it’s clear that further tax cuts would be irresponsible.

If President Trump makes this his economic message going into 2020, he could frame the election as one of realism versus socialist fanaticism.

That sounds to me like an election that Trump can win. In fact, it sounds like an election in which only a fool would vote against him.

– – –

Nicholas L. Waddy, an associate professor of history at SUNY Alfred, blogs at www.waddyisright.com.

Mr. Waddy has got it almost right. The one flaw in his case is embodied in the last sentence: “…only a fool would vote against him.” The problem is that there are a lot of fools in the nation who vote in favor of preposterous things. If you doubt that, just look at the mess they’ve created in California and some other blue states (Washington, Oregon, and Colorado in particular).

Why not both tax cuts and fiscal responsibility. They surely are not mutually exclusive. In fact I would claim that they go hand in hand.